arizona charitable tax credit fund

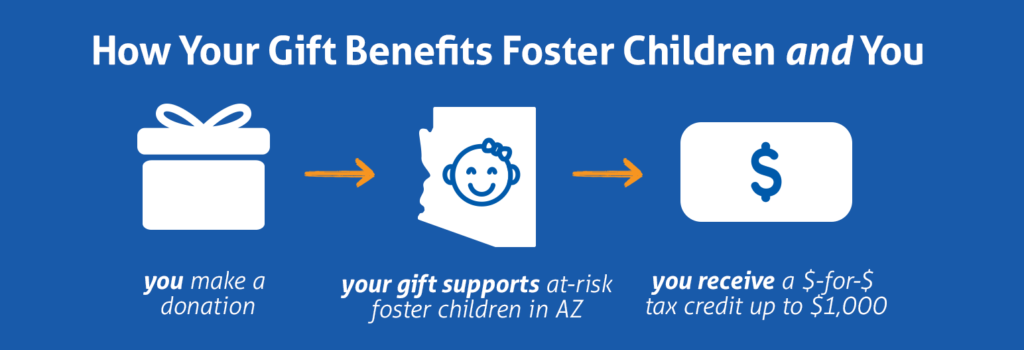

Your donation then can be taken as a dollar-for-dollar tax credit on your Arizona income tax obligation IN. Fortunately the process for making a charitable contribution and claiming the Arizona Charitable Tax Credit is relatively straightforward.

Arizona Charity Donation Tax Credit Guide Give Local Keep Local

Public Education Tax Credits This tax credit opportunity allows you to donate to a public school and receive up to 400 tax credit when you file.

. Donate up to 400 per individual or 800 per couple to Ronald McDonald House. Visit The Official Edward Jones Site. What is the relationship between the YMCA of Southern Arizona and the YMCA Tax Credit Fund LLC.

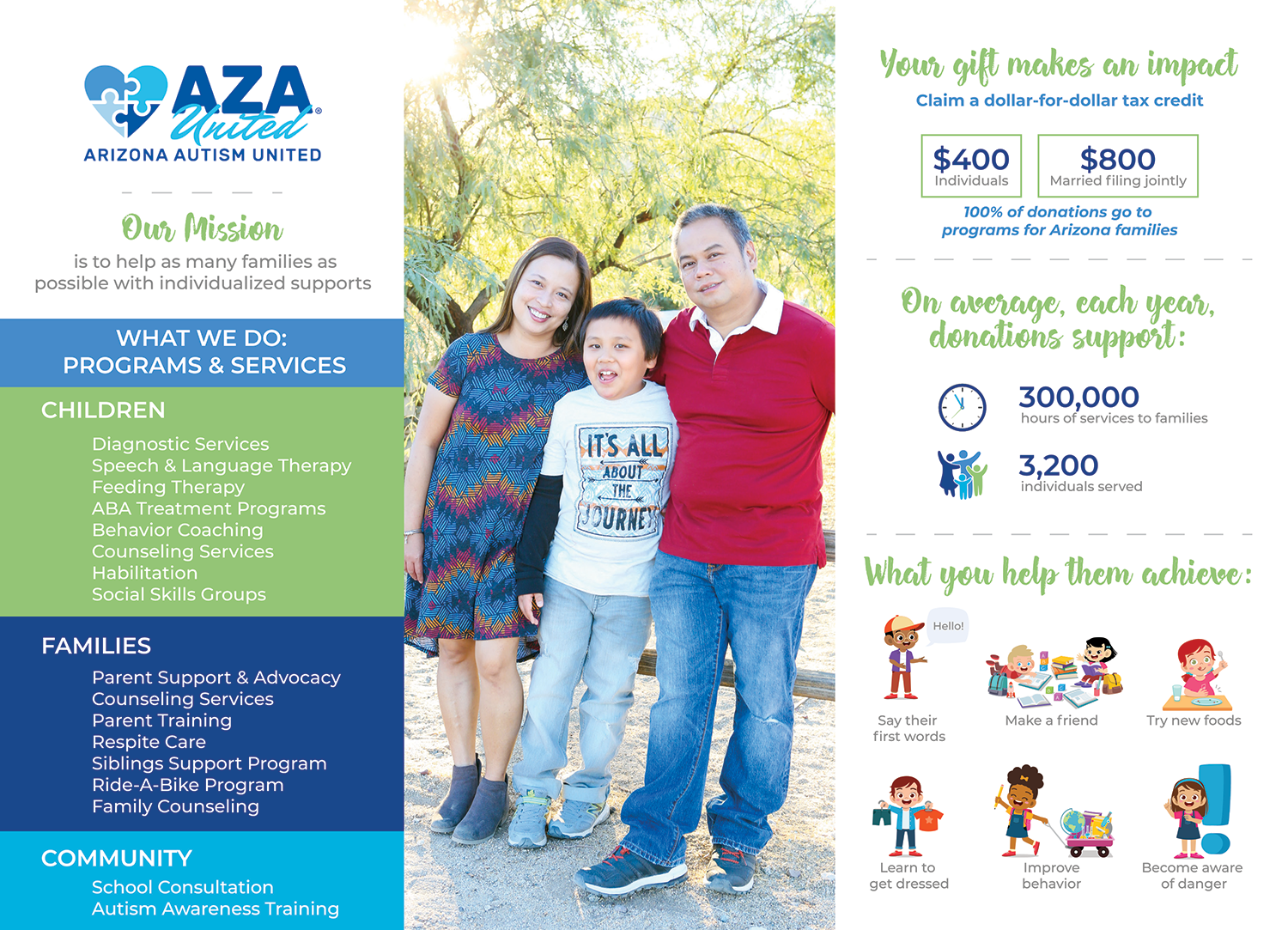

Ad Learn About Charitable Trends Behaviors and Priorities of High Net Worth Americans. Ad Premium Federal Tax Software. The Arizona Charitable Tax Credit allows individuals to donate to a qualified Arizona nonprofit organization and claim a dollar-for-dollar state tax credit of up to 400.

Individuals who pay income taxes to the State of Arizona can redirect their tax dollars to help benefit the SandRuby. Here are five important things that you need to know about Arizona Charitable Tax Credit. Qualified Charitable Organizations - AZ Tax Credit Funds.

Learn how AZ tax credits can decrease an Arizona residents income tax liabilitywhat you need to know about qualifying and claiming it on your taxes. Only cash contributions qualify for the charitable tax credit. Single filers can now claim up to 400 in gifts to FSL as a dollar-for-dollar tax credit.

Our Qualifying Charity Organization QCO number is 20941 Tax ID. Ad Find Az Tax Credit Donations. The Arizona legislature recently made some exciting changes to the Arizona Charitable Tax Credit.

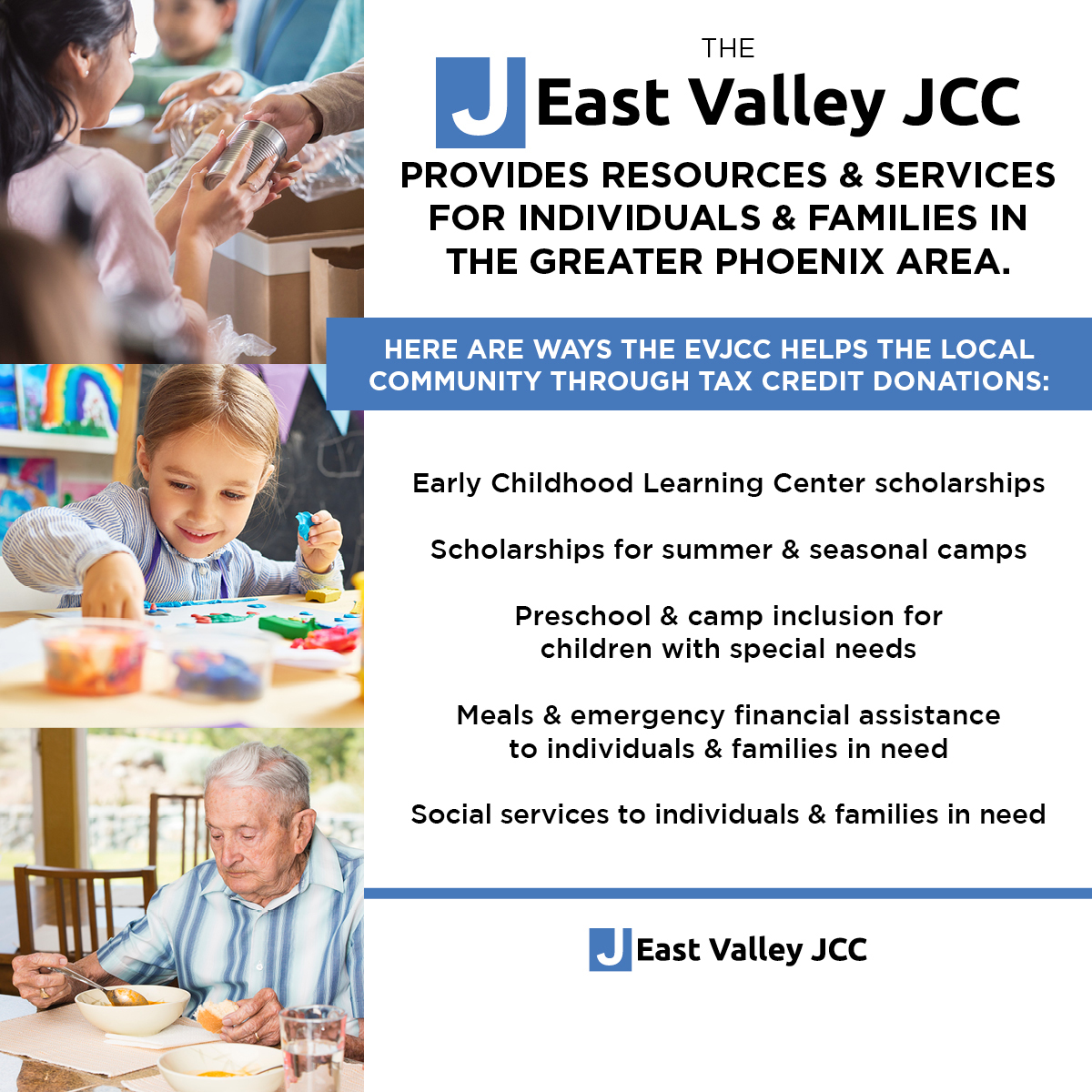

Information on the Arizona Charitable Tax Credit. Tax donations are credited only to individuals. This individual income tax credit is available for contributions to Qualifying Charitable Organizations that provide immediate basic needs to residents of Arizona who receive.

Through the Arizona Charitable Tax Credit Arizona taxpayers have an added incentive to make a donation and receive a dollar-for-dollar tax credit. Arizona Charitable Tax Credit Give families togetherness AND get an Arizona state tax credit. The Arizona Charitable Tax Credit was created to help taxpayers support charities that offer services to low-income residents with chronic illnesses or disabilities.

E-File Today Get Your Refund Fast. Have the unique opportunity to actually redirect a portion of the state tax dollars they owe or already paid to an organization that. The Arizona Charitable Tax Credit goes to help SandRuby and the members.

The Arizona taxpayer must first donate the maximum for the original School Tuition Organization Tax Credit in order to donate an additional amount for the PLUS Switcher. There are four steps to document your donation and. An Edward Jones Financial Advisor Can Partner Through Lifes Moments.

All Extras are Included. Private Education Tax Credits This tax credit. New Look At Your Financial Strategy.

Donate up to 400 single filer and up to. You will receive a dollar-for-dollar state tax credit against your State of Arizona taxes owed up. Bank of America Private Bank Is Here to Help with Your Philanthropic Goals.

Ad Learn About Charitable Trends Behaviors and Priorities of High Net Worth Americans. This fund has an annual cap of 1 million meaning after 1 million has been donated for the year subsequent donors cant claim the tax credit. Bank of America Private Bank Is Here to Help with Your Philanthropic Goals.

Thanks to the Arizona Charitable Tax Credit program you have an incentive to support Care Fund. Make your tax credit donations from one easy-to-use site.

Arizona Charity Donation Tax Credit Guide Give Local Keep Local

Cdt Kids Charity Arizona Tax Credit

Cdt Kids Charity Arizona Tax Credit

Qualified Charitable Organizations Tucson Tax Credit Funds

Qualified Charitable Organizations Az Tax Credit Funds

The 2022 Definitive Guide To The Arizona Charitable Tax Credit Phoenix Children S

Qualified Charitable Organizations Az Tax Credit Funds

Qualified Charitable Organizations Az Tax Credit Funds

Start The Process Az Tax Credit Funds

Arizona Tax Credits Mesa United Way

List Of 6 Arizona Tax Credits Christian Family Care

Get Arizona Tax Credits When You Donate To St Mary S Food Bank

The Arizona Tax Credit Give Local Old Pueblo Community Services

List Of 6 Arizona Tax Credits Christian Family Care

Know Each Tax Credit S Limit 2021 Fsl Org

Arizona Charitable Tax Credit Can Benefit Hcc

![]()

Qualified Charitable Organizations Az Tax Credit Funds